Our Location

304 North Cardinal St.

Dorchester Center, MA 02124

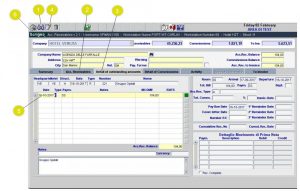

In the screenshot below, we have indicated the details of the A/C repair service commission expense accounting rendered, including the rate which is $150. You’ll also notice that when you click on the deposit, it expands and you can choose to edit. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Let’s find out why the Deposit to option isn’t showing up on your customer payment in QuickBooks Desktop.

After recording the bank deposit in QuickBooks Online, it’s important to take the final step of verifying that the undeposited funds have been cleared. This ensures that all the selected payments have been appropriately moved from the undeposited funds account to the bank account, and your records are accurate. Once you are satisfied with the transaction details, save the transaction to record the bank deposit successfully in QuickBooks Online. This completes the process of moving the selected payments from the undeposited funds account to your bank account within your financial records. Now that you have reviewed and finalized the bank deposit details, it’s time to record the deposit in QuickBooks Online. This step ensures that the funds are accurately reflected in your bank account and that your financial records are up to date.

Once discrepancies are identified, they must be investigated to determine the cause, which can range from human error to issues with electronic transfers. After that, record a bank deposit so that you can combine the transactions from your Undeposited funds account and match them to your deposit in bank feeds. You can edit the individual payment details within the bank deposit form by clicking on the respective field.

You have successfully cleared undeposited funds in QuickBooks Online, maintaining accurate financial accounting scandals records and streamlining your bookkeeping process. Regularly performing this task will keep your records up to date and contribute to a clear and organized financial picture of your business. Once you’re in the undeposited funds account, you will see a list of the payments that have been recorded but not yet deposited. Make sure that all the payments are from customers and that they correspond to actual invoices or sales receipts.

This provides you with real-time feedback on the total funds that will be moved and recorded in the bank deposit. This will open the bank deposit form where you can enter the details of your deposit. On this form, you will see fields for the date, deposit to account, payment method, and reference number. Fill in these fields accurately to reflect the specific details of your deposit.

Remember, it’s essential to regularly review, organize, and reconcile your financial records to ensure their accuracy and integrity. If you encounter any discrepancies or have specific questions, consult with a professional accountant or refer to the QuickBooks Online resources for further guidance. Review the list to confirm that the payments you selected for the bank deposit no longer appear in the undeposited funds account.

Thorough verification not only resolves discrepancies but also contributes to the overall integrity and reliability of financial data, a fundamental aspect of effective reconciliation. Small businesses can greatly benefit from the visibility and control over their cash inflows that regular reconciliation offers, contributing to their long-term financial stability. Did you connect your Clio account as a bank feds or through app integration on our QuickBooks Online App menu? That way, we’ll be able to give ways to match your Clio payment to your QuickBooks Online records. That’s why you don’t need to combine transactions or use Undeposited Funds because QuickBooks already has the information from your bank. For example, if you need to provide additional information or notes about the deposit, like the source of the funds, you can add those details in the memo or notes section of the transaction.

You must use the Undeposited Funds account only for payments that are physically collected, including cash and paper checks. This process involves identifying the undeposited funds, verifying the reasons for their deletion, and making corresponding adjustments in the account. It is crucial to maintain a clear trail of documentation to support the deletion, such as notes detailing the reason for the adjustment and any approvals required. Transparency is key, and any changes made should be well-documented and easily traceable. Deleting undeposited funds in QuickBooks requires careful consideration and accurate adjustments to ensure that all financial records remain consistent and transparent. absorption dictionary definition Fixing undeposited funds in QuickBooks Online requires a systematic approach to identify and resolve any discrepancies or issues related to pending payments and deposits.

It is essential to begin by reconciling all open invoices with the corresponding bank deposits. Ensure that each payment is correctly linked to a deposit in the Undeposited Funds account. In case of any discrepancies, double-check the payment and deposit entries to ensure accuracy. The process of clearing undeposited funds in QuickBooks Online involves several important steps to ensure accurate recording and reconciliation of payments. Recording undeposited funds appropriately is crucial for maintaining transparency and accuracy in financial reporting. By managing undeposited funds effectively, businesses can gain a clear picture of their cash flow, reduce errors, and maintain a precise record of their financial activities in QuickBooks Online.

This proactive approach also enhances the overall accuracy and reliability of financial reports, providing a solid foundation for informed decision-making and financial planning. Following these steps will enable you to effectively clear undeposited funds in QuickBooks Online, ensuring that your customer payments are properly recorded and deposited into your bank account. Regularly performing this task will keep your financial records accurate and up to date.